White-labelling SyncHub

Imagine SyncHub. Our customers visit our site then create their account and connect their data sources. They start with a trial and if they like what they see, they move to a paid plan.

Now, imagine it again, but this time with your own branding. Under your own URL. And with custom pricing tiers, backed by your own Stripe account. This, my friend, is SyncHub’s white-labelled offering.

And it just might be the missing piece of your BI or consultancy business.

TL;DR;

You run your own SaaS or consultancy company. You have a lot of customers with similar reporting requirements, who need to access their data in real-time. You don’t have the time or technical skills to build and maintain an integration engine, but nor do you want to send your customers off to a third-party site to connect their data

By white-labelling SyncHub, your data-extraction problems are taken care of, plus you get all these other amazing benefits included:

Branding. Use the SyncHub engine to access your customers’ SaaS data in real-time - all under your own branding

Client onboarding. Customers can authorize their own data connections, using (for example) the OAuth2 handshake or tokens, and then grant you access to their SyncHub data warehouse for reporting

Payments. SyncHub can charge you directly, or your customers may pay individually using their own credit cards

Pricing. SyncHub will recoup its standard fees per client, but you can control the ultimate price paid by your customers by connecting your own Stripe account. Set your own pricing tiers and features. Offer the service for free to your clients, or roll your own fees into our service and essentially use SyncHub as a payments provider

Data security & privacy. Our bring-your-own-database solution lets you store your client data in a database owned and controlled by you

We start with a story…

Let’s consider for a moment, a fictional platform called Reports4U. Reports4U offers customized BI dashboards and reports for many of today’s most popular SaaS platforms, like Xero, HubSpot & monday.com.

The development and BI teams at Reports4U are very good, but reports are only as good as the data they run on and getting data from third-party services is hard. This is where SyncHub’s white-labelled offering can step in.

I’ll show you a quick preview of how it looks, so you can imagine it while you’re reading, then we’ll break down the features under the surface.

Look familiar? Of course - it’s exactly the same system that SyncHub’s own public offering is built on. If you’re an existing user of SyncHub, then you’ll recognize this already. But what you won’t realize is all the additional benefits that a white-labelled version of SyncHub will offer. So, let’s break down the features now.

Reports4U’s customers need to use the SyncHub engine to connect their data, but the last thing they want is to sign up to “another” SaaS platform. By applying their own branding, Reports4U immediately gave their customers familiarity and peace-of-mind during the data connection process.

Custom URL and email domains

Notice the URL in the screenshot above - connect.reports4u.com. Yes, that is a sub-domain underneath Reports4U’s own top-level domain. All that the Reports4U team needed to do is add a new CNAME record on their DNS, and our team at SyncHub wired it up to the SyncHub application.

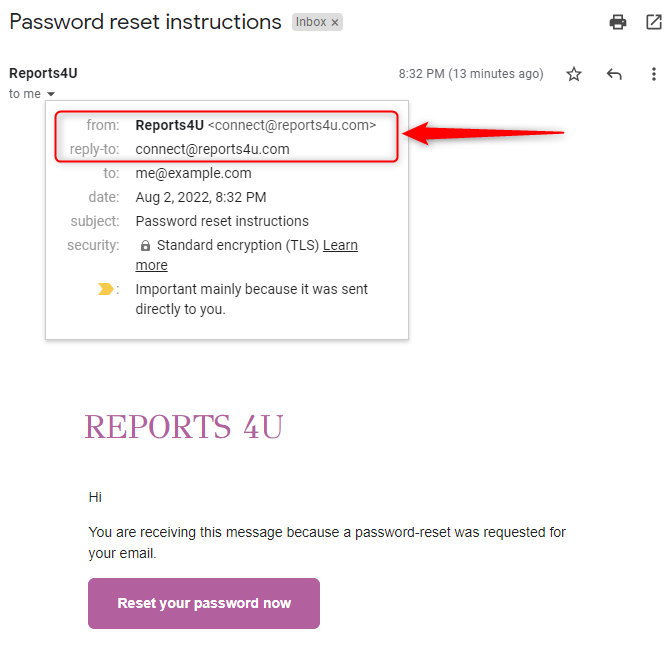

Speaking of DNS, SyncHub sends the occasional email to customers, such as disconnection notifications or password reminders. Reports4U added DKIM and SPF records to this DNS too, and now all comms from our platform to their customers are done via their own email address:

Pretty slick, right?

Colours and logos

Obviously, you get your own colours and logos applied to your site too (technically you have a whole CSS stylesheet to work with).

Onboarding new clients is incredibly easy. Initially, Reports4U would onboard customers manually (see the ‘New client’ button in the screenshot later). But ultimately they simply let customers register themselves at connect.reports4u.com/register. The SyncHub workflow quickly walks customers through connecting their SaaS platforms - and the Reports4U team doesn’t have to do a thing.

Once the clients are signed up, they’re available to the Reports4U team under their Client Management module…

…and of course the team can manage every aspect of their account:

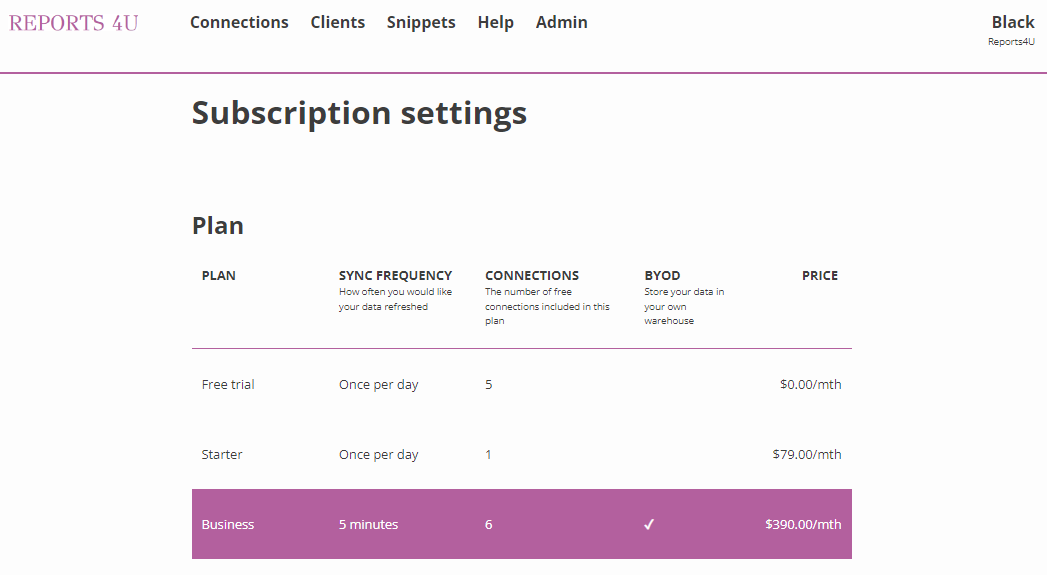

Astro has got a couple of connections to Xero and Katana, and they’re on the Business Plan, which means their data is updated every 5 minutes.

Connecting to your client’s data warehouse

As you can see, Astro Tires have signed themselves up to Reports4U, and connected their Xero and Katana accounts. Reports4U can now simply grab the credentials for Astro’s new data warehouse and plug this into their reports engine. Voila - the Reports4U dashboards are now rendering with live data from Astro’s Xero and Katana accounts.

Pssst - alternatively, Reports4U might choose to use our new Insights module to build and share their reports

SyncHub offers a range of payment architectures, and Reports4U actually took advantage of each one as their business evolved.

Option 1/3 - SyncHub bills Reports4U directly

To get up and running quickly and ease customer onboarding, Reports4U wanted SyncHub to send them an aggregate invoice each month, which covered the costs of each individual customer account. This made things really easy for their customers, as they didn’t have to concern themselves with submitting payment information, or their trial expiring etc.

Pros

Customers can easily connect their data without concern for payment setup

Cons

Reports4U had to split their invoice each month and disburse charges to each customer as required

Customers cannot change their plan themselves

Reports4U were charged each month for SyncHub services, with no guarantee that they could recoup those charges from each individual customer

Option 2/3 - SyncHub bills customers directly

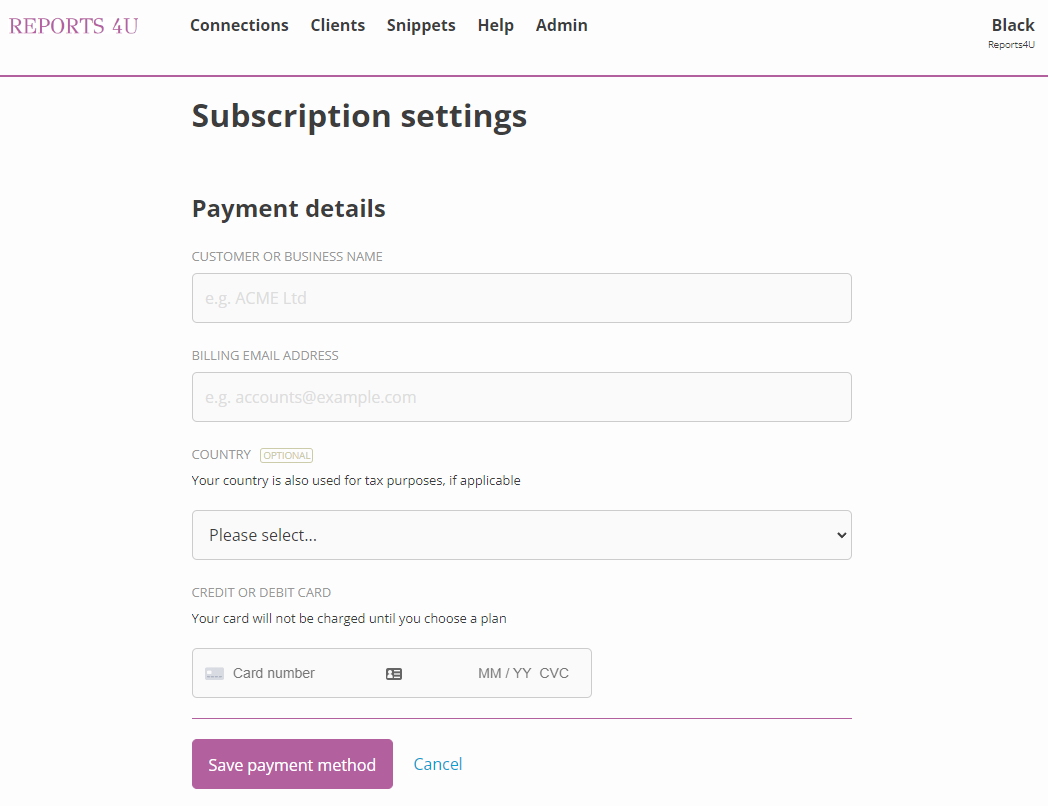

As Reports4U grew, the hassle of disbursing charges and the risk of non-payment convinced Reports4U to let SyncHub charge customers directly. Now, as customers onboard, they are able to enter their credit card information directly into the SyncHub dashboard, and they have complete control over their plan:

Pros

Customers were entirely responsible for paying their own bills. If a non-payment occurs, SyncHub automatically sends reminder notifications and eventually deactivates the service

Customers may switch between plans any time they like

Cons

Customers got multiple invoices each month - one from SyncHub, and one from Reports4U for their BI Dashboard service

The invoice from SyncHub each month was SyncHub-branded

Having customers take care of their own payments each month relieved Reports4U of a massive administration burden, but the invoicing was a problem. Specifically, customers questioned why they were getting two invoices each month.

The answer to all these problems was Stripe Connect. By setting up a (free) Stripe account and then connecting it to SyncHub, Reports4U were able to have customers pay their bills individually and have these payments automatically split & disbursed between SyncHub and Reports4U. And this meant that Reports4U could now adjust the prices that their customers were charged for the SyncHub engine. The Reports4U team decided to ditch their own invoice to their customers each month and instead roll their BI Dashboard pricing into the single SyncHub bill each month.

Pros

Customers are now charged directly via credit card month. If a non-payment occurs, SyncHub automatically sends reminder notifications and eventually deactivates the service

Customers may switch between plans any time they like

Customers get a single invoice each month

SyncHub’s standard charges are automatically split and disbursed each month, and the rest goes to Reports4U. Stripe will take care of refunds, pro-rata payments etc

Cons

Well, to be honest, none that we can think of

SyncHub as a payments provider (?!)

We didn’t set out to build a payments provider for our white-labelling customers, but that is essentially what we ended up doing. With this new flexibility, Reports4U ended up ditching their own billing engine and charged all their services through SyncHub by setting their own marked up prices for each of SyncHub’s pricing plans.

Stripe Connect is free, and the setup with SyncHub is incredibly simple. With this combination, SyncHub now becomes a plug-in-play solution for both the data and payments for any BI SaaS offering.

If data governance policies prevent your clients from trusting their data to a third-party storage solution, our BYOD service lets you store their data in a server and database of your own choosing. Find out more in this detailed blog article.

Bonus - the SyncHub Services Store

Once they were setup with their white-labelled account, Reports4U decided to list their services on the SyncHub Services Store. The Services Store is an SEO-optimized marketplace where consultants can advertise their services to the entire SyncHub customer base.

Now, the white-labelled platform does the heavy lifting, the Services Store feeds them customers, and the Reports4U team focusses on what they are good at - building reports.

Summary

No consultant or BI SaaS gets excited about data extraction, but it’s a necessary first step if you want to provide your customers with rich real-time reports and dashboards. Unfortunately, due to it’s highly specialized technical nature, many service offerings are unable to progress past this step.

SyncHub can fill this gap with a plug-and-play solution that gets customer data where and when you need it, all under your own brand.